On Nov. 22, 2022, The England and Wales High Court, Edwin Johnson, J. in the chair, stated ” I am satisfied that there is a good arguable case that the Alleged Fraud, by which I mean a major international fraud, took place. Indeed on the evidence, and while it is not necessary to go this far, I think that there is more than a good arguable case that the Alleged Fraud took place. The evidence that a major international fraud took place seems to be strong…………….. Money advanced to the Winsome group was allegedly “misappropriated, laundered and concealed through multiple layers of corporate entities, with the vast majority of the proceeds said to have ended up in entities owned and/or controlled by the Mehta family in different parts of the world including the UAE”.

The respondents in these cases were Jatin Mehta, Sonia Mehta, Vishal Mehta, Suraj Mehta and Haytham Salman Ali Abu Obidah. The matter related to drawing down of $1 billion in gold from bullion banks and consortium banks that financed these purchases. Since no payment was made by the consignees within the stipulated 270 days, all the purchasers defaulted, the worst affected being Stanchart and Stanchart India. During the proceedings, the petitioners contended that the payments for this gold were siphoned into two layers of companies, hence Johnson, J. classed it as an international fraud and allowed it to the tried in the UK.

This was when the CBI had filed a closure report while acknowledging the inter-company transfer of funds by the defendants (Mehtas). Winsome Diamonds and its founder Jatin Mehta, with his wife Sonia and two sons Vipul and Suraj, vanished from India and have never returned, leaving behind a loan default documented at Rs 6,800 crore, but could be more.

In May 2022, a UK court had acted on SCB’s petition and issued a ‘World Freezing Order’ (WFO) to secure assets of the value of £743,176,152.77 (or US$932,466,942.36) belonging to the Mehta family and also impounded their passports. The November order is in response to a petition by the Mehtas to have the WFO lifted. Explaining ‘near total default’ in repayment of a billion dollars, it was argued on behalf of the Mehtas that their UAE distributor had sold jewellery to his customers and then lost the money owed to the Winsome group in commodity transactions.

This explanation ‘takes some swallowing’ said the court, finding it “extraordinary that a loss on this scale could occur in this way.” The UAE distributor, Haytham Salman Ali Abu Obidah, was described as a ‘close associate’ of Jatin Mehta and listed as the fifth defendant but did not participate in the proceedings, since he could not be located!

Nearly a decade has passed but no visible action has been taken by the Govt. of India in even locating the errant Mehtas. In uncharacteristic hurry, CBI filed a ‘lengthy’ closure report in March 2021. Nothing is available in the public domain to suggest either that CBI obtained a Blue Corner Notice from Interpol to trace the Mehtas or pursued the matter successfully even as the Mehtas were resident in London and fighting their legal battles from there.

Typically though, the CBI report equivocated and there was no clean chit. Although the Mehtas tried to use it in their favour, the court observed, “It contains nothing which is finally conclusive one way or the other.” On the contrary, it highlighted some damning paragraphs. For instance, CBI says, “Investigation revealed that all the exports were made to related parties based in UAE. Statement of witnesses recorded in group cases reveal that the control of all the UAE buyers was in the hand of Shri Jatin R. Mehta and Smt. Sonia J. Mehta.

The entire functioning of 13 defaulting companies was handled by the employees of Smt. Sonia J. Mehta who was owner of M/s Oriental Expression DMCC, Noble Jewellery LLC and Oriental Jewellery LLC” (emphasis as in the order). The CBI closure also noted how employees received purchase orders from exporters on Skype calls with no details about design, weight and specification of product (gold). Instead, after “processing the gold the manufacturing heads of units at Chennai and Cochin used to inform the employees” of Winsome group that the consignment was ready, therefore “it give rise to suspicion that there was some hanky-panky going on in these two companies.”

Another factoid emerging from the order was that CBI registered 16 complaints against the Winsome group, of which “only one resulted in any charges being issued” against them. Given that CBI’s criminal proceedings were ‘unresolved’ but ‘closed’, the court refused to place much reliance on them. The order showed that the actions of Indian lenders were studiously vague. Instead, the Mehtas remained cocksure that they were out of harm’s way. “It is a notable feature of this hearing that direct evidence from the Respondents (Mehtas) is very limited. There is ample evidence from their solicitors, but very little from the Respondents themselves.” It stated that they offered ‘no direct evidence’ which “provides a plausible explanation of how the movement of the funds was legitimate” through layers of companies.

It affirmed that Jatin Mehta “has not taken the opportunity to set out his own account of how the Defaults came about.” What is most ironic was that the UK court found there is a ‘good arguable case’ and ‘strong’ evidence of an huge international fraud, but Indian investigators and lenders were apparently in no hurry to bring back Jatin Mehta and family or recover a few thousand crore Rupees owed to them. Mehta and wife fled the country and in 2013-2014, took investor citizenship of St Kitts and Nevis, with which India had no extradition treaty.

Surprisingly, the Mehtas are based in London, a fact mentioned by the UK High Court in its order of Feb 15, 2023. Interestingly, Johnson J. also ruled that since the defendants were resident in London for several years and had no prospects of returning to India, trial would proceed in UK jurisdiction. Yet, Indian lenders and investigative agencies turned a blind eye right from 2014-23. This was possible only when the phone calls from the highest executive office on the land rang at the desks of banks, CBI and many others after 2014.

Now comes the first twist in the tale. Four Mauritius-based funds that have attracted attention for parking almost all their money in companies controlled by Gautam Adani have a history of investing in firms which ended up defaulting or were investigated for wrongdoing. Before they placed about 90% of their $6.9 billion under management in the Adani empire, the funds — Elara India Opportunities Fund, Cresta Fund, Albula Investment Fund and APMS Investment Fund — held significant stakes in two companies whose founders fled India and have since been probed for money laundering, another that went bankrupt, and a fourth that was liquidated after sparring with the Ethiopian government.

Now comes the first twist in the tale. Four Mauritius-based funds that have attracted attention for parking almost all their money in companies controlled by Gautam Adani have a history of investing in firms which ended up defaulting or were investigated for wrongdoing. Before they placed about 90% of their $6.9 billion under management in the Adani empire, the funds — Elara India Opportunities Fund, Cresta Fund, Albula Investment Fund and APMS Investment Fund — held significant stakes in two companies whose founders fled India and have since been probed for money laundering, another that went bankrupt, and a fourth that was liquidated after sparring with the Ethiopian government.

In a written reply July 19, 2022, to questions raised by TMC MP Mohua Moitra (a former senior investment banker herself) posed in Parliament, India’s state finance minister Pankaj Chaudhary said neither the funds nor Adani firms are being investigated by the Enforcement Directorate, the Indian agency that probes serious financial crimes like money laundering and round-tripping. Some Adani group companies were being examined by the capital markets regulator Securities and Exchange Board of India for compliance with securities rules as well as by the department that looks at import and export taxes, Chaudhary said without elaborating, and cited rules that forbade him from disclosing any income tax investigations. Chaudhary also disclosed names of people registered as responsible for each of the funds.

Bloomberg that investigated this issue could not find contact details for Markus Beat Dangel, Anna Luzia Von Senger Burger, and Alastair Guggenbuchi Even and Yonca Even Guggenbuehl, identified in the response to Parliament as controlling or otherwise responsible for Cresta, Albula and APMS, respectively.

The funds were also among the largest foreign shareholders in Winsome Diamonds and Jewellery Ltd., Sterling Biotech Ltd., Ruchi Soya Industries Ltd. and Karuturi Global, companies they previously invested in that went bankrupt or were being investigated. As of Dec. 31, 2011, Elara, Cresta and Albula together held a 8.62% stake in Winsome Diamonds; All four funds each held at least a 1% stake in the company at some point in the six years to June 30, 2015.

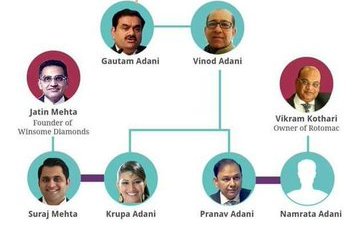

Now, the second twist. Jatin Mehta’s son, Suraj, is also Vinod Adani’s son-in-law (via daughter Krupa) since 2012.

Vinod Adani was responsible for international trading for the Ahmedabad-based group, especially the import of gold into India. According to an Economic Times report (2012) Adani Exports (now Adani Enterprises) traded in about Rs 2430 crore of gold in 2008 and made a profit of Rs 179 crore. This gold trade was probably where the interests of the Adanis and the Mehtas coincided.

Another factoid that emerged as I read though media coverage on Winsome Diamonds was that Grant Thornton, along with Stanchart, was spearheading the litigations against the Mehtas in the UK. This is the same accountancy firm that the Adani Group appointed for audit of its accounts in the wake of the Hindenburg revelations.

Also Read: Adani Bubble: A Researched Prick

Latterly, Adani Group denied having appointed Grant Thornton. Clearly, the Adani Group belatedly realized that appointing Grant Thornton would not only be a conflict of interest but expose the multiple links that the Adani brothers had with the Jatin Mehtas. What is of the greatest concern is the near-total inaction of the Govt. of India, indeed facilitating the absconding Mehtas (despite knowing they were resident in London) for close to a decade since 2014 that the UK Court will, doubtless, have the freedom to raise.

And this was when the Mehtas were the second largest loan defaulters after Vijay Mallya. While Mallya has been hounded, in stark contrast, Mehta (a Gujju) has been protected by the Indian state. The Adani connection my have ensured just that.

Also Read: How LIC is robbing the illiterate Indian Blind?

Since the UK High Court’s order in Nov., 2022 and Feb. 2023, six other Indian lenders, many of them PSBs, have joined the litigation by Stanchart and Grant Thornton. Maybe they will get some part of their moneys back now that neither Indian investigators nor courts will deal with this trial. What is worse for the Adani Group is that a long-winded trial will dig up innumerable snake pits exposing snakes in them. The familial links between the Adanis and the Mehtas will provide more fodder for the Indian opposition in the run-up to GE 2024. ![]()

___________

Also Read:

TRUTH VS FALSEHOOD: BBC – Who is afraid?

Mughal Gardens – Name Changed, But Why?

Industrialization versus Environmental Degradation

Punjab – How a deadly cocktail of Agri-Water-Energy nexus going to destroy it?

North Pole and the ideological conflict of RSS & Hindutva

Disclaimer : PunjabTodayTV.com and other platforms of the Punjab Today group strive to include views and opinions from across the entire spectrum, but by no means do we agree with everything we publish. Our efforts and editorial choices consistently underscore our authors’ right to the freedom of speech. However, it should be clear to all readers that individual authors are responsible for the information, ideas or opinions in their articles, and very often, these do not reflect the views of PunjabTodayTV.com or other platforms of the group. Punjab Today does not assume any responsibility or liability for the views of authors whose work appears here.

Punjab Today believes in serious, engaging, narrative journalism at a time when mainstream media houses seem to have given up on long-form writing and news television has blurred or altogether erased the lines between news and slapstick entertainment. We at Punjab Today believe that readers such as yourself appreciate cerebral journalism, and would like you to hold us against the best international industry standards. Brickbats are welcome even more than bouquets, though an occasional pat on the back is always encouraging. Good journalism can be a lifeline in these uncertain times worldwide. You can support us in myriad ways. To begin with, by spreading word about us and forwarding this reportage. Stay engaged.

— Team PT

Copyright © Punjab Today TV : All right Reserve 2016 - 2025 |