The Hindenburg Research report on the Adani empire makes for riveting reading, albeit takes about an hour at least.

![]() While my friends have shared the report, very few seem to have read/understood the implications. I am no stock exchange person but was able to logically distill some facts from this voluminous report as follow:

While my friends have shared the report, very few seem to have read/understood the implications. I am no stock exchange person but was able to logically distill some facts from this voluminous report as follow:

1. Adani is no different from a small family-owned business. While Gautam bhai is the ultimate arbiter, his family moonlights as outsourced agents. The longer your criminal history, particularly criss-crossing the globe, the faster are promotion prospects in this group – Chinese or Gujarati swindlers do not matter for they make excellent partners in bed.

2. The modus operandi is not to difficult to understand. Take an initial borrowed corpus from a willing lender like SBI and then rotate it among group companies, via LLPs and a network of shadowy private companies. Then shift these funds from company to company pushing up the cash balance of each at different time (within the same financial year), pushing up stock prices and then seeking more borrowings, particularly from SBI and other institutional investors.

3. As for group incomes, these too are siphoned into the network of private companies, and reinvested in listed group companies, yet again to shore tattered P&L accounts, mired in debt. (2) above + incomes together dress the P&L account and create an illusion of well-being of this group in the mind of an investor. In turn, that helps in mopping funds from investors and banks without ever having to think of debt default. In other words, this is a giant Ponzi scheme, in which you rob Peter to pay Paul.

4. As for auditors for this enterprise, these are no different from articled clerks at 23-24 years of age. Getting a true and fair view from these fellows is a breeze. How very thoughtful!!

5. How does this Ponzi operate? Say, Adani Enterprises borrows $100 million from SBI. It then takes it on its own balance sheet. Then it redistributes the ‘surplus’ to either group companies or its network of dubious companies. The proceeds are held in relatively small denominations (say, $10-15 million) and act as a reserve pool for transfer whenever a group entity needs infusion to boost its cash balance and stock price without exciting any suspicion from enforcement agencies in India or overseas.

6. It is not difficult to launder proceeds of crime in this process. Generating fictitious invoices, over for export and under for import is a breeze in the overseas jurisdictions where the network is located; the physical existence of saleable output is not even a must. Even if GOI agencies catch up with Adani, the latter’s Patron Saint ensures that investigations come to naught. It is from these slush funds that election campaigns are paid by the ruling party.

7. As for the network companies, the less said the better. Nearly all have no web sites (the few that do, use terms that are delightful nothing), offices, personnel, yet fork out billion dollar loans to Adani entities. That is why there is unified command of Gautam bhai’s older brother.

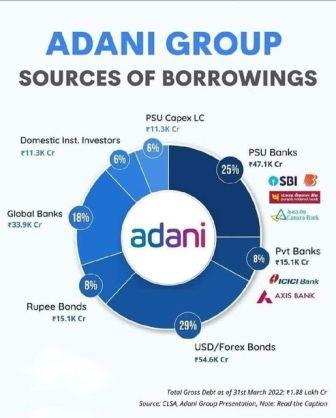

8. Why is the group the favourite child of SBI and sundry other PSBs? That is because they are the only ones that will loan unlimited funds upon the security of shares that are worse than a untamed horse. No sarkari banker dares look in detail at the balance sheets and P&L accounts for assets and their true valuation, lest they lose their jobs, even sent to jail on trumped charges. The end result is that a large part of this group’s debt of almost INR 4 lakh crore has little or no asset base; the valuation of assets is but a chimera. Today, when Adani stocks have taken a Rs. 46000 crore hit, there is no sarkari bank that will ask this group to cough up margin money of 50%, lest the truth stumble out and public hits the street causing a run on SBI or any other PSB.

8. Why is the group the favourite child of SBI and sundry other PSBs? That is because they are the only ones that will loan unlimited funds upon the security of shares that are worse than a untamed horse. No sarkari banker dares look in detail at the balance sheets and P&L accounts for assets and their true valuation, lest they lose their jobs, even sent to jail on trumped charges. The end result is that a large part of this group’s debt of almost INR 4 lakh crore has little or no asset base; the valuation of assets is but a chimera. Today, when Adani stocks have taken a Rs. 46000 crore hit, there is no sarkari bank that will ask this group to cough up margin money of 50%, lest the truth stumble out and public hits the street causing a run on SBI or any other PSB.

9. What is even more intriguing is that the Dept. of Financial Services, MoF or GOI that superintends all PSBs (including appointing their CAs, approving their annual accounts and appointing all Directors & CMD/CEO) does not discharge its duties, particularly when the banking acts preclude any audit by the National Auditor (CAG). With the sovereign power of the GOI behind it, this Dept. has never directed a special audit of any PSB that would have brought Adani loan terms & conditions under the scanner. Should the FM not be asked to answer in Parliament?

10. Finally, it is common knowledge that stock brokers trade shares and keep a healthy margin on the sale of each share. Higher the share value, greater their commission; of course, a part goes for political funding as well as quid pro quo for questions not being asked by regulators. Why else do you think a mega operator like Ketan Mehta, despite being barred from trading by SEBI for 14 years, continues to ply his Indian business from comfy London while retaining his old clients (like Adani) using proxies? Are brokers the only ones that earn a handsome commission? The answer is an emphatic no. Loan sanctioning officers in PSBs are no less but they must part with the larger part to their political masters as slush funds. The whole trade reeks of rent-seeking of mind-boggling figures, yet no corrective action is ever taken, across political regimes.

1. Cooked and dressed balance sheets of Indian collaborators for foreign companies will now be subject to far greater level of scrutiny by foreign investors, particularly in the critical infrastructure sector. In turn, that may raise the cost of borrowing and cause penal clauses to be liberally inserted in contracts linked to completion of milestones, among many other restrictions.

2. Indian regulators when allowed to freely function are a very solid lot. Remember the KL cadre IAS officer (Abraham?) who was ED, SEBI and put Subroto Roy in the locker? Later in life, when his turn to become CS in his home state came, he was arbitrarily overlooked – Subroto Roy evidently had his charmed circle! As for SEBI, the scanner needs to be put on the quality of its output of orders and enforcement action. If sarkari babus are inept, then SEBI should hire Hindenburg and many others out there. The power to hire these agencies must rest with the Chairperson alone and not need the Minister’s sanction.

2. Indian regulators when allowed to freely function are a very solid lot. Remember the KL cadre IAS officer (Abraham?) who was ED, SEBI and put Subroto Roy in the locker? Later in life, when his turn to become CS in his home state came, he was arbitrarily overlooked – Subroto Roy evidently had his charmed circle! As for SEBI, the scanner needs to be put on the quality of its output of orders and enforcement action. If sarkari babus are inept, then SEBI should hire Hindenburg and many others out there. The power to hire these agencies must rest with the Chairperson alone and not need the Minister’s sanction.

3. Is Adani the only business group indulging in malpractice? Evidently, every business needs to maximize its profit and share a ‘bit’ of it with their political masters of the day. The problem is when such malpractice outgrows regular practice as has happened with the Adani Group. I am sure all other biz biggies like the Birlas, Tatas, Mahindras, Goenkas, et al have their own secrets. How about letting SEBI do some long overdue diligence on them? Then there is that tabby cat in M/o Corporate Affairs called the Registrar of Companies that collects humungous amount of data from the public but hardly ever uses it, otherwise 50% of India’s biz Czars would have been in the locker by now.

Also Read: TRUTH VS FALSEHOOD: BBC – Who is afraid?

4. Now for the make-up artistes, the ICAI. Adani’s CA boys must be outstanding to have cleared their twin set of qualifying exams even before they were 22 years old and become so proficient that they could be deployed in the Adani maze! Yet ICAI has no defined code of conduct for its senior practitioners. The silence from ICAI is not surprising, nor is it the first time. The fortunes of both CAs and their biz clients is more closely intertwined than that of a husband and wife. If SEBI were to punish a body corporate, it must also be empowered to revoke the license of a CA. Instead, look at the action ICAI’s Ethics Committee has taken over the decades and you realize the extent of their twinning.

5. The loudest message that goes out from L’Affaire Adani is that to grow your business by 300% per annum and obtain ready and willing domestic finances with the blessings of the nation’s CEO, you need to work only with Adani. The rest do not matter. What happens to the BJP’s much-touted India Story, in that case?

5. The loudest message that goes out from L’Affaire Adani is that to grow your business by 300% per annum and obtain ready and willing domestic finances with the blessings of the nation’s CEO, you need to work only with Adani. The rest do not matter. What happens to the BJP’s much-touted India Story, in that case?

6. With extraordinary leverage, Adani’s financiers will insist on making good the drop in share value, either in cash or issuing more equity from the promoter’s quota to the banks for public sale. At INR 2.35 lakh crore gross debt and 30%+ decline in share value by next week, overseas financiers (who account for over a third) could seek INR 25-35K crore from the Adani Group. Already, the first step has been taken with LIC subscribing $37 million to the Adani FPO but that is peanuts. Now wait and watch how other sarkari banks and FIs, maybe some PSUs, also pitch in. And please remember that the last named hold your money and mine. And that does not matter as the investigators like CBI and ED have already received their orders to keep Adani safe.

Also Read: Hidenburg’s Adani report: RBI, SEBI should probe charges

7. Last, but not the least, is the fact that the tom-tommed India Story has fallen at the feet of a crony capitalist. Is that ease of doing biz and evading all accountability? Which respectable foreign investor will invest in the IPOs of major Indian companies mired in mazes of deceit and corruption? ![]()

___________

Also Read:

Mughal Gardens – Name Changed, But Why?

Industrialization versus Environmental Degradation

Punjab – How a deadly cocktail of Agri-Water-Energy nexus going to destroy it?

North Pole and the ideological conflict of RSS & Hindutva

Politics of Symbolism: Dalit Chief Ministers in India

Disclaimer : PunjabTodayTV.com and other platforms of the Punjab Today group strive to include views and opinions from across the entire spectrum, but by no means do we agree with everything we publish. Our efforts and editorial choices consistently underscore our authors’ right to the freedom of speech. However, it should be clear to all readers that individual authors are responsible for the information, ideas or opinions in their articles, and very often, these do not reflect the views of PunjabTodayTV.com or other platforms of the group. Punjab Today does not assume any responsibility or liability for the views of authors whose work appears here.

Punjab Today believes in serious, engaging, narrative journalism at a time when mainstream media houses seem to have given up on long-form writing and news television has blurred or altogether erased the lines between news and slapstick entertainment. We at Punjab Today believe that readers such as yourself appreciate cerebral journalism, and would like you to hold us against the best international industry standards. Brickbats are welcome even more than bouquets, though an occasional pat on the back is always encouraging. Good journalism can be a lifeline in these uncertain times worldwide. You can support us in myriad ways. To begin with, by spreading word about us and forwarding this reportage. Stay engaged.

— Team PT

Copyright © Punjab Today TV : All right Reserve 2016 - 2026 |