Shreegireesh Jalihal and Nitin Sethi/The Reporters’ Collective

THE NDA GOVERNMENT allowed millers to fatten themselves on tonnes of pulses meant for the poor by turning an auction procedure on its head.

Since 2017, Nafed, the government’s procurement agency that picks millers to process raw pulses for welfare schemes, held over a thousand auctions without setting a base rate or floor that jump-starts any auction and a fail-safe switch to prevent millers from hiding profit.

The auctions let millers earn a bloated revenue of at least Rs 4,600 crore in four years from milling over 5.4 lakh tonnes of raw pulses, hammering government coffers and possibly the quality, show documents in public domain and accessed through RTI. The pulses were for the beneficiaries of welfare schemes across the country and defence services.

The stink from the rotten auction process rose up when states complained to the Union government about the bad quality of processed daal provided as part of Pradhan Mantri Garib Kalyan Yojana (PMGKAY) during the Covid-19 lockdown. Some states rejected the processed pulses as they were not fit for consumption.

The government is now trying to undo the damage. Internally, the government has asked for a review of these dubious auctions, multiple government officials told the Reporters’ Collective. The corrective step is being couched in a benign term — ‘reforms’.

The government’s leading research institute, Central Institute of Post-Harvest Engineering & Technology (CIPHET), too, has sent the government a report on the auctions.

“We have submitted a report to the government recommending how Nafed should procure, store and process the pulses,” said CIPHET’s director Nachiket Kotwaliwale.

The report has forced the government to set up an inter-agency committee to review how millions of tonnes of pulses are procured, stored and milled by Nafed, a business that costs the taxpayer thousands of crores.

The committee met thrice so far but is yet to finalise its recommendations even as Nafed gets ready for another year of procurement and milling of pulses.

Genesis

The auctions that enrich pulse millers first came in the name of farmers and the poor.

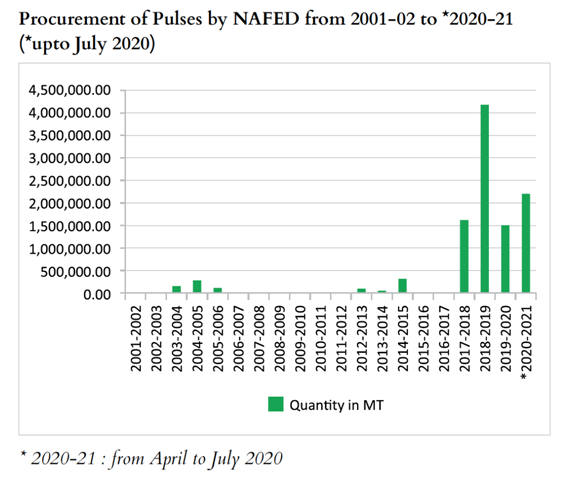

In 2015, when India faced “daal shock” as prices of pulses such as peas and pulses soared, Nafed was put in charge of procurement. Nafed convinced farmers to produce more pulses by promising to buy up their produce. As stocks piled up with Nafed, it proposed in 2017 that the government offer pulses to states under welfare schemes at subsidized and affordable prices.

Nafed and the Union government decided they would get the raw pulses milled and delivered to the state governments. Nafed had before it a transparent practice of paddy milling auction through which the government finds the lowest possible price at which a bidder is ready to process paddy.

This is how it works: if the government wants 100 kg of Urad milled into 70 kg of processed daal, the potential millers would calculate the costs of de-husking, splitting and polishing the pulses, packing and transporting the processed daal. They would factor in the revenue from selling the by-products, add their profit and quote a price. The government would pick the lowest bid as the winner.

But Nafed, working as the Union government’s agent, upended this simple auction process.

The bidders are now not asked to quote the lowest possible price to mill pulses and deliver to designated places. Instead, they are asked to quote the highest possible Out-Turn Ratio or OTR.

In the business of milling, OTR is a jargon for the ratio between the quantity of final good a miller churns out and the quantity of raw commodity they get. So, the miller who offers the highest quantity of finished pulses or highest OTR from raw stock wins.

What’s enriching pulses millers and undermining the exchequer is: Nafed’s auctions don’t have a lower limit on the OTR a miller can bid — a value known as ‘floor’ in bidding. A mere 1% change in this ratio can set the government back by hundreds of crores against bills raised by millers.

Floor limit in OTR was not new in the business of pulse milling either. It has been put in place by states as a safeguard against cartelisation and undervaluation.

A tender to process chana daal (chickpeas)was floated on August 19, 2020, by the Andhra Pradesh State Civil Supplies Corporation. It set the floor OTR at 70%, in effect capping the maximum profits the millers could make from the contract.

However, Nafed went ahead with the new method despite the Comptroller and Auditor General (CAG) in 2015 finding that such an OTR method had benefited rice millers. Low OTR allowed millers to retain excess rice, causing nearly Rs 2,000 crore in loss to the government.

The auction methodology was also brought before the Central Vigilance Commission in 2020 alleging the auctions caused losses worth over Rs 1,000 crore and demanding a thorough audit. But nothing came of the complaint.

Show me the money

If no money exchanged hands between Nafed and the millers under the OTR auction, how do millers make profit?

If no money exchanged hands between Nafed and the millers under the OTR auction, how do millers make profit?

Since there is no floor value, millers quote an OTR lower than what they would be able to achieve from a particular grade of daal. The excess daal is sold along with the by-products in the open market to make profit.

But how much is enough profit? That’s what Nafed failed to write into the business model. Neither Nafed nor the government has a clue on the market rates at which millers sell this excess quantity of processed daal and how much total profit they made on each tender.

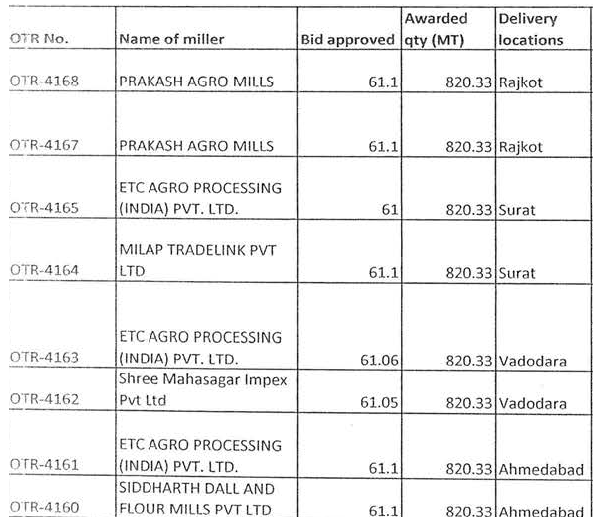

The Reporters’ Collective analysed auctions and found that under the PMGKAY scheme to provide pulses to the poor during Covid-19 lockdown, the approved OTR for tur (pigeon peas) was nearly 8% lower than the floor values set by the Tamil Nadu government in 2018.

Minimum OTR for a Tur Dal processing tender floated by Tamil Nadu government, dated 26/10/2018 was 68%

Approved bids for the same commodity under PMGKAY go as low as 61 — 8% lower than the minimum Tamil Nadu government suggested in 2018

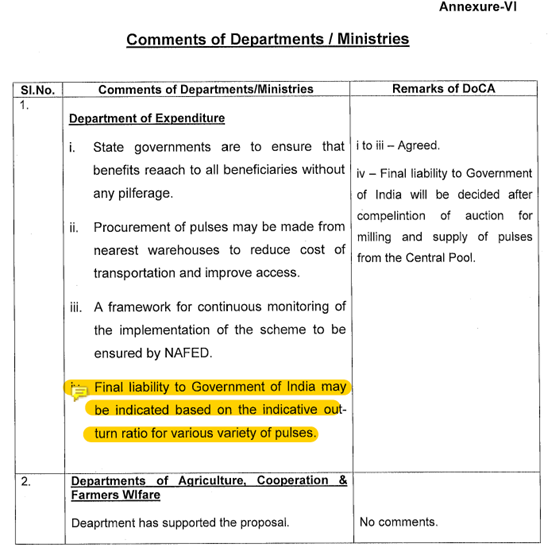

Documents also show that the Department of Consumer Affairs overruled a recommendation from the Department of Expenditure to calculate the cost of milling and supplying pulses under PMGKAY on the basis of OTR.

By doing so, it prevented any real assessment of whether approved OTRs were viable.

To a question why Nafed hadn’t set floor value, the agency said: “The cost involved in transportation from warehouse to mill point, loading, unloading, processing, packing and further transportation to the delivery points varies in each of the auctions as the locations of warehouses and delivery points are different.

“…It is therefore not possible to put any floor values and conversion templates before conducting the auctions.”

“Moreover, the objective of the OTR-based auction was to convert the raw pulses into milled pulses without paying any extra amount on account of all additional cost incurred during supply of milled pulses to the delivery depots of the states,” Nafed said.

“NAFED had chosen to conduct auctions based on OTRs as per the modalities approved by the Department of Consumer Affairs with a view to complete supplies of pulses to the needy one in the shortest time possible,” Nafed told the Reoprters’ Collective with reference to PMGKAY. (Nafed’s full reply is appended at the end.)

However, auction archives show that OTR auctions were held years before the pandemic began. Access to Nafed’s data on how it decides the winning OTR value in these auctions is stonewalled by a Delhi high court order that shields it from RTI queries.

The Reporters’ Collective began reviewing the milling auctions under PMGKAY after reports said bad quality pulses were supplied to states. The complaints could be tied to the new auction rules that gave extra rope to the millers.

When governments distribute food grain under welfare schemes, the grain reaching beneficiaries is assumed to be of the same stock procured from farmers. But the changed auction rules allow millers to supply the country’s poor pulses from the open market and keep the government-procured stock of the same quantity for their own commercial use.

Delivering pulses from the open market is one of the two options millers have under Nafed’s milling auctions. The other option — take stock from Nafed, process and then deliver — comes with a downside: hefty deposit.

A miller who participated in the PMGKAY auctions said, “Mostly, supply under these auctions was by dispatching stock from the local market and lifting Nafed’s raw material after delivery. Lifting stock and then processing it for delivery would involve a large bank guarantee.”

“Nafed doesn’t really care if the daal supplied is from the chana they procured. They only want delivery of a particular specification made to the location,” said a senior industry official who requested anonymity.

This runs afoul of what Nafed says is the supply chain process of PMGKY in its December 2020 docket. Milling and distribution, in reality, worked like a barter system.

NAFED’s public claims of how pulses were milled and distributed under PMGKAY is in complete contradiction to what actually happened.

Nafed reasoned that new auction rules, which let millers switch stocks, were brought in to quicken distribution as the Covid-19 pandemic pummelled supply chain and logistics. But since the rules were rolled out in 2017, it is clear that the solution wasn’t thought up during the pandemic.

“NAFED had allowed millers to deliver first lot of pulses from their end and then pick up raw pulses which are utilized for subsequent milling in view of lockdown all over the country. On the other hand, it was the need of the hour to supply pulses to the needy in time. Had this been not done; NAFED could not have ensured timely supplies. NAFED has successfully completed the supply across India in the shortest time possible.”

Nafed wasn’t forthcoming on how it ensures the stock millers deliver is of the same quality they pick up from Nafed. It said, “Nafed purchases stock of pulses under PSS (price support scheme) confirming to FAQ (fair average quality) specifications. The stock is subsequently transferred to maintain a buffer of pulses. It may be concluded that the stock of pulses lying in Buffer are all of the same quality…”

The Delhi government in April 2020 suspended grain supply while Punjab more than once complained of poor quality and in May 2020 returned 46 tonnes of pulses to the Centre. “NAFED not only got the stocks assayed at the mill level as far as possible but also at delivery points. The State/UT Governments had accepted the stocks only when they were satisfied about the quality of the pulses,” Nafed said.

“If there were some complaints…, the stocks were replaced by the millers to the satisfaction of the states. After successful delivery of stock, maintenance of quality till stock is distributed was the responsibility of the state department.”

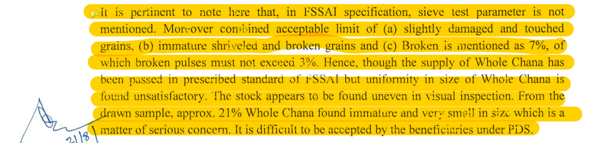

In August 2020, Gujarat informed the Centre that 21% of a sample of whole chana was found unfit for distribution.

Nafed said Gujarat’s civil supplies “department rejected the stock due to non-uniformity in grain sizes, which is not a parameter under FSSAI.”

“As per the approved modalities, the supplies of pulses should conform to the FSSAI specifications. Whereas the Department of Civil Supplies, Govt of Gujarat has tested supplied pulses on its own parameters.”

The FSSAI standards that Nafed uses to defend its auction processes and the quality of raw and processed pulses are meant for small retail, not for procurement from farmers or supplies to states at large scale.

Centre had also overturned Gujarat’s suggestion to introduce pulse quality inspection at the milling points along with delivery points saying it could hold up dispatch.

CIPHET has now recommended that Nafed should follow scientific standards for procurement and milling to ensure quality. The report, sources in the government said, if followed up could end Nafed’s auction games. ![]()

For Punjabi version of this story, please click here.

This story was originally published by thewire.in

_________________

Also Read:

Global Arms Trade: Who are the real winners?

Parliament Proceedings: Would You Please Walk The Talk, Mr Prime Minister?

Demystifying Demonetization — War on Black Money or Legalized Plunder and Organized Loot?

Need to amend laws like UAPA to provide for punishment for those who slap false

Why not 40 pc tickets for women in Punjab and elsewhere?

Punjab – How a deadly cocktail of Agri-Water-Energy nexus going to destroy it?

North Pole and the ideological conflict of RSS & Hindutva

Jallianwala Bagh Renovation – A Memoricide of Punjab

Politics of Symbolism: Dalit Chief Ministers in India

Disclaimer : PunjabTodayTV.com and other platforms of the Punjab Today group strive to include views and opinions from across the entire spectrum, but by no means do we agree with everything we publish. Our efforts and editorial choices consistently underscore our authors’ right to the freedom of speech. However, it should be clear to all readers that individual authors are responsible for the information, ideas or opinions in their articles, and very often, these do not reflect the views of PunjabTodayTV.com or other platforms of the group. Punjab Today does not assume any responsibility or liability for the views of authors whose work appears here.

Punjab Today believes in serious, engaging, narrative journalism at a time when mainstream media houses seem to have given up on long-form writing and news television has blurred or altogether erased the lines between news and slapstick entertainment. We at Punjab Today believe that readers such as yourself appreciate cerebral journalism, and would like you to hold us against the best international industry standards. Brickbats are welcome even more than bouquets, though an occasional pat on the back is always encouraging. Good journalism can be a lifeline in these uncertain times worldwide. You can support us in myriad ways. To begin with, by spreading word about us and forwarding this reportage. Stay engaged.

— Team PT

Copyright © Punjab Today TV : All right Reserve 2016 - 2024 |