Experts and Organizations Outline Key Priorities for Economic Growth, Social Justice, and Minority Upliftment

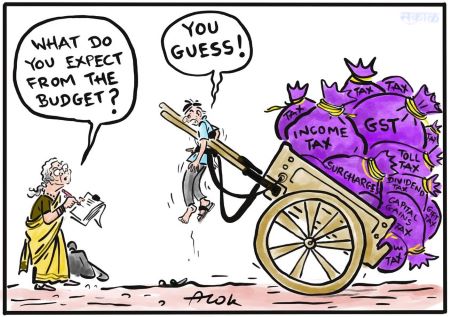

THE INDIAN BUDGET 2025 is poised to address a myriad of challenges, shaped by both domestic and global dynamics. As the world’s most populous nation and a rapidly growing economy, the fiscal policies outlined in this budget will have significant implications across sectors.

India, like many nations, continues to recover from the economic disruptions caused by COVID-19. While growth is rebounding, sustaining this momentum remains a challenge amidst fluctuating global demand, supply chain disruptions, and rising costs of raw materials.

Adding to these pressures are global economic uncertainties, including potential recessions in developed economies, which could impact India’s export sector and lower GDP growth forecasts for 2025. Inflation, particularly in the food and energy sectors, remains a pressing issue, requiring balanced measures to support vulnerable populations without derailing broader economic stability.

Adding to these pressures are global economic uncertainties, including potential recessions in developed economies, which could impact India’s export sector and lower GDP growth forecasts for 2025. Inflation, particularly in the food and energy sectors, remains a pressing issue, requiring balanced measures to support vulnerable populations without derailing broader economic stability.

Perspectives from Experts

Professor Arun Kumar, a noted economist, highlighted critical concerns about India’s GDP calculation, stating:

“Post-demonetization in 2016, the GDP has been reported as growing at over 5%, but in reality, it may not exceed 1-2% if the informal sector is accurately accounted for. The informal sector constitutes nearly 94% of the economy but is largely ignored in official calculations. Addressing this requires a focus on agriculture and small businesses to drive employment and reduce inequalities.”

Prof. Arun Kumar

Professor Kumar also advocated for reforms in the Goods and Services Tax (GST) framework to benefit the informal sector. He emphasized:

“This sector doesn’t receive input credit under GST, leaving formal businesses to benefit disproportionately. Reforming GST to include the informal sector is essential for equity.”

On the social sector, Professor Kumar stressed the need for increased investment in health, education, and skill development.

He proposed reforms in corporate tax, simplification of income tax, and mechanisms to extract taxes from the informal sector to generate resources.

Further, he called for wealth, inheritance, and gift taxes to address income inequalities, noting examples from Malaysia, which successfully managed capital controls to prevent economic disruptions.

He concluded: “Implementing such measures requires political will, which can be mobilized through social movements and collective action involving the working class, women, and marginalized groups.”

Sadatullah Husaini, President of Jamaat-e-Islami Hind, outlined the following proposals:

Expenditure Recommendations:

Sadatullah Husaini

1. MGNREGA Expansion: Reverse the 33% budget cut and introduce an urban equivalent to address urban unemployment.

2. Boost Rural Economy: Establish rural employment hubs focusing on renewable energy, agro-processing, and organic farming, while developing high-quality rural townships.

3. Support MSMEs: Allocate resources for subsidized credit, technological upgrades, tax incentives, and infrastructure to revive MSMEs and enhance job creation.

4. Healthcare and Education: Increase healthcare spending to 4% of GDP, expand Ayushman Bharat coverage, and launch a “Mission Shiksha Bharat” dedicating 6% of GDP to education.

5. Empowering Minorities and Marginalized Groups: Revive scholarships, establish interest-free loans, and create skill development zones in minority-concentrated districts.

6. Agrarian Solutions: Address the agrarian crisis through debt relief, guaranteed MSP, interest-free loans, expanded crop insurance, and irrigation projects.

6. Agrarian Solutions: Address the agrarian crisis through debt relief, guaranteed MSP, interest-free loans, expanded crop insurance, and irrigation projects.

7. Universal Basic Income (UBI): Phase in UBI for vulnerable groups, backed by Aadhaar-enabled direct benefit transfers.

Revenue Suggestions:

1. Cap GST on essential goods at 5% and introduce a luxury goods tax to balance revenue without burdening the common people.

2. Implement a windfall tax on net assets above ₹1,000 crore and reinstate a 30% minimum corporate tax for large corporations.

3. Raise states’ share in central taxes from 41% to 50% to enhance local welfare programs.

4. Levy digital taxes on foreign tech companies and e-commerce platforms profiting from Indian consumers.

5. Launch tax-exempt infrastructure bonds to fund critical development projects.

Educational Focus for Minorities

Prof. Mohammed Saleem

Professor Engineer Mohammed Saleem, Chairman of the Markazi Taleemi Board, emphasized the need to increase India’s education budget from 2.9% to 6% of GDP, in line with the National Education Policy (NEP) 2020. He highlighted the following recommendations:

1. Halt privatization of education and ensure accessibility for all citizens.

2. Reduce fees at prestigious institutions like IITs, IIMs, and medical colleges to increase accessibility.

3. Expand scholarships for marginalized communities, improve ICT infrastructure, and establish universities dedicated to traditional crafts and skills.

4. Upgrade madrasas with modern educational systems and allocate special budgets for Urdu-medium schools.

4. Upgrade madrasas with modern educational systems and allocate special budgets for Urdu-medium schools.

5. Build hostels for Muslim girls and strengthen school management committees for minorities.

Professor Saleem appealed to the Finance Minister to incorporate these suggestions into the Union Budget 2025, noting that such measures would enhance the social and economic conditions of minority communities.

Jawed Alam Khan

Jawed Alam Khan, Executive Director of the Institute of Policy Studies and Advocacy, further recommended increasing the total budget allocation for the Ministry of Minority Affairs (MoMA). He called for making scholarship schemes demand-driven and ensuring additional financial resources to enhance unit costs and revise income eligibility criteria.

Conclusion: The Union Budget 2025 presents an opportunity for the government to address pressing economic challenges, reduce inequalities, and uplift marginalized communities. The recommendations from experts and organizations highlight the need for targeted reforms in taxation, investment in social sectors, and focused initiatives to promote equity and economic growth. Incorporating these suggestions will be pivotal in steering India toward inclusive and sustainable development. ![]()

Also Read: India Must Not Miss This Bus

Disclaimer : PunjabTodayNews.com and other platforms of the Punjab Today group strive to include views and opinions from across the entire spectrum, but by no means do we agree with everything we publish. Our efforts and editorial choices consistently underscore our authors’ right to the freedom of speech. However, it should be clear to all readers that individual authors are responsible for the information, ideas or opinions in their articles, and very often, these do not reflect the views of PunjabTodayNews.com or other platforms of the group. Punjab Today does not assume any responsibility or liability for the views of authors whose work appears here.

Punjab Today believes in serious, engaging, narrative journalism at a time when mainstream media houses seem to have given up on long-form writing and news television has blurred or altogether erased the lines between news and slapstick entertainment. We at Punjab Today believe that readers such as yourself appreciate cerebral journalism, and would like you to hold us against the best international industry standards. Brickbats are welcome even more than bouquets, though an occasional pat on the back is always encouraging. Good journalism can be a lifeline in these uncertain times worldwide. You can support us in myriad ways. To begin with, by spreading word about us and forwarding this reportage. Stay engaged.

— Team PT